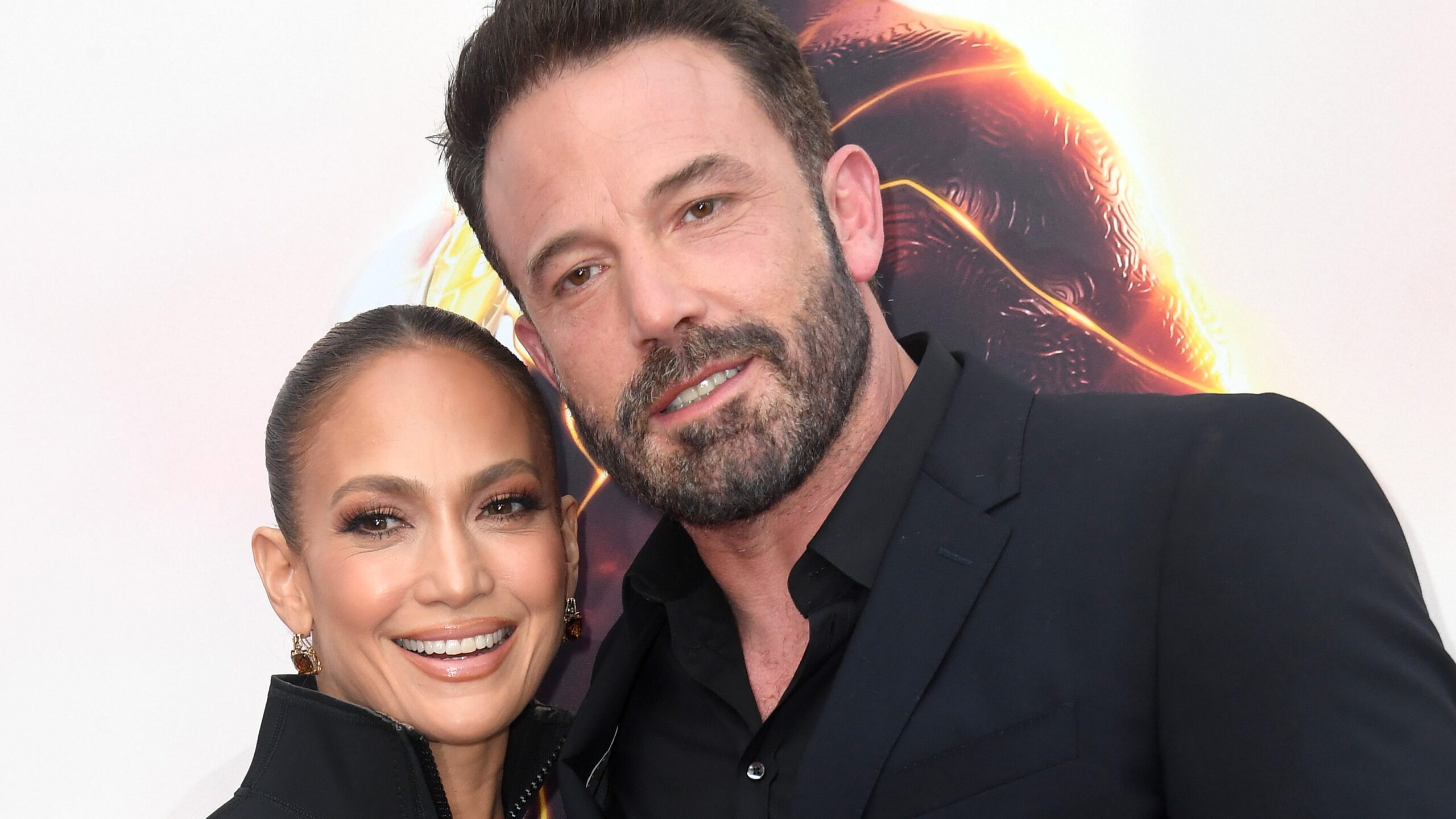

Jennifer Lopez and Ben Affleck were married twice last year, once on July 17 in Las Vegas and then again on August 20 in Georgia, but it wasn't until May of this year that the couple bought a home together. It took them about a year to find their dream home and when they found it, they plunked down $60.85 million in cash to buy it outright. Nice! But then in August, the couple decided to take out a $20 million mortgage on the property.

More from MamásLatinas: Jennifer Lopez's most iconic fashion moments

The megastar couple is worth about $300 million combined. Why would they need to take out a mortgage on a place they already own? Are they in some kind of financial trouble and need money fast? Did they spend too much on their weddings? What the heck is going on here and why would two such rich people need to use their home to secure a huge loan from a bank instead of using their own money for whatever? Let's get into it.

Let’s talk about the Beverly Hills mansion in question.

It's one of those homes that comes with a name and the name is Wallingford Estate. Fancy! The estate includes a 12-bedroom 24-bathroom home, a gym, basketball and pickleball courts, a boxing ring, and so much more. It even has a full-on hair and nail salon.

Not only did they get a deal on the place, they paid for it in cash.

In 2018, Wallingford Estate was listed for $135 million. However, Bennifer reportedly only paid $60.85 million for it in cash. Can you even begin to imagine having that much cash at your disposal? Crazy!

The couple took out a $20 million home loan with JPMorgan Chase.

The U.S. Sun reports that in August, just a few months after purchasing the home, the couple took out a 30-year, $20 million mortgage out on it. For the first six years, the interest on the loan is 5.5%, after which the rate increases, but they don't even have to start making payments until 2033.

Does this mean they are broke and need cash?

Probably not. They might just be opting to get the home loan instead of a personal loan so they can use the money for something else. "The interest rate on a loan that's secured by real property is lower than what they'd get on a personal loan. The interest is also tax deductible," realtor Tony Mariotti, CEO of RubyHome Luxury Real Estate, told The U.S. Sun.

"They can use the funds almost any way they want, which would not be the case if it were an unsecured loan. For those reasons, it's a smart financial move."

"By move, I mean any number of things like buying more properties, renovating existing properties, financing a project such as a film production." Phew! No need for us to worry about Bennifer's finances. They are just making smart dinero moves.

Apparently, this isn’t an uncommon practice.

"This is a common tactic among the wealthy for the tax benefit. No doubt, they have financial advisors—or maybe they make their decisions independently—that consider their entire asset portfolio and start to calculate the best way forward for any given move," added Tony Mariotti, who isn't involved in this particular deal, but appears to know what he's talking about.